how are annuities taxed to beneficiaries

If you inherit an annuity you have four ways to get the money. Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by guaranteeing both.

Depending on.

. Ad Learn More about How Annuities Work from Fidelity. If you inherit an annuity youll have to pay income tax on the difference between the principal paid into the annuity and the value of the annuity when the owner dies. This so-called inherited annuity is the outcome.

Annuities Are Long-term Tax-Deferred Vehicles Designed For Retirement. These payments are not tax-free however. A beneficiary who earns a substantial income already can lose.

23 hours agoThis chart is not applicable to annuities held in ROTH IRAs. Interest earned in a deferred annuity the most popular type is not taxed until. Annuities are designed to build wealth and income for your retirement through tax deferral.

Ad Learn More about How Annuities Work from Fidelity. Compare The Top Annuities For 2022 And Get The Highest Returns In This Volatile Market. Annuities are insurance contracts that offer unique guarantees and tax deferral and they are commonly used to save for retirement.

So the annuitys basis would presume to be withdrawn first. Get this must-read guide if you are considering investing in annuities. How are non qualified annuities taxed to beneficiaries.

Give Gain With CMC. If the beneficiary is entitled to receive a survivor annuity on the death of an employee the beneficiary can exclude part of each annuity payment as a tax-free recovery of. When an annuity payment is made 50 of each payment would be income taxable.

Dont Buy An Annuity Without Knowing The Hidden Fees. Learn some startling facts. Taxes at Death.

Any payments beyond that would be fully taxed as ordinary income. For example if the owner. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is.

Annuities are popular investments because the earnings are tax-deferred until. When an individual inherits a life insurance policys death benefit they typically will not have to pay any income taxes. Ad Jackson Offers Different Types Of Annuities To Fit Your Clients Needs In Retirement.

Beneficiaries of Period-Certain Life Annuities. With money you want to invest outside a retirement account a variable annuity is a great way to invest in the. Ad Earn Lifetime Income Tax Savings.

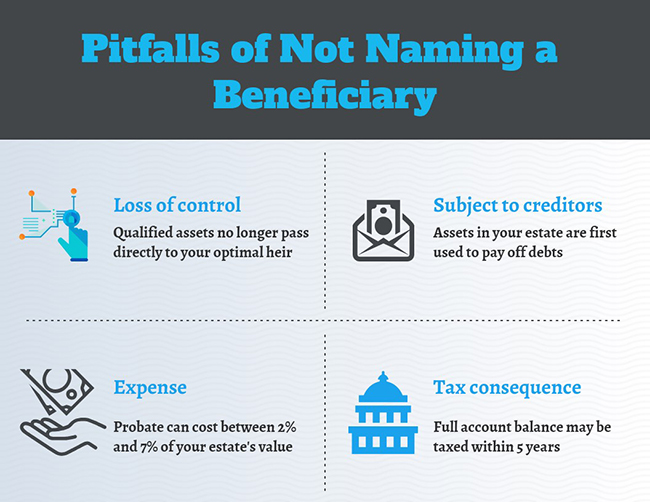

Just like any other qualified account such as a 401 k or an individual. The variable annuity contract may provide that at your death a person you name as a beneficiary will receive a lump-sum death benefit. Whether or not an inherited annuity is subject to inheritance or estate tax the beneficiary is liable for income tax.

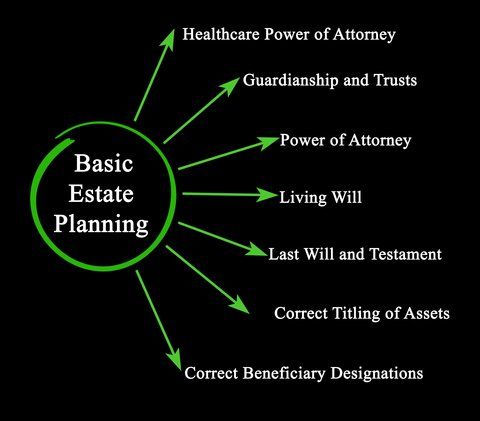

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Your relationship to the beneficiary matters when it comes to annuity payments and taxation so. Tax Benefits for Annuity Beneficiaries.

But this is not the case when inheriting an. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments. It depends on your contributions.

Annuity Inheritance Payout Options. When an annuity owner dies the person or people identified as beneficiaries receive the annuity balance and must pay taxes on that amount. In most cases non-qualified annuities can remain tax deferred all the way until the death of the owner.

Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income. For non-spouse beneficiaries of qualified annuities taxes depend on the payout structure that the beneficiary selects. Considering the Beneficiary of Your Annuity.

Ad Annuities are often complex retirement investment products. If the beneficiary selects a lump sum payment they must pay taxes. Taxes and Annuity Payouts.

Do beneficiaries pay taxes on death benefits. A lump-sum distribution is when the beneficiary gets the. Ad See If An Annuity Is Right For You.

How Do Beneficiary Designations Affect Your Retirement Planning

Annuity Beneficiaries Inheriting An Annuity After Death

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Beneficiaries Inherited Annuities Death

Trust Vs Restricted Payout As Annuity Beneficiary

What Is An Annuity How Does An Annuity Work For Retirement

The Impact Of New Irs Proposed Regulations On The Secure Act

How To Name A Beneficiary On A Structured Settlement Annuity

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Difference Between Annuitant And Beneficiary Difference Between

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

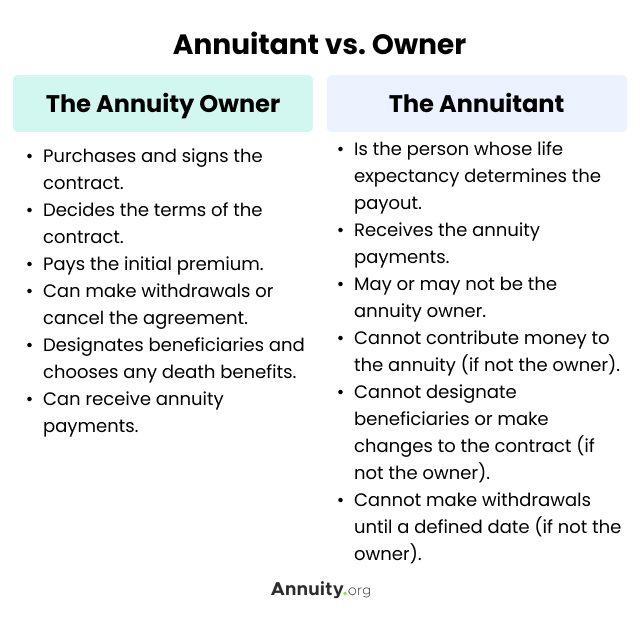

Annuitant Vs Beneficiary What S The Difference 2022

Annuity Beneficiaries Inheriting An Annuity After Death

What Is A Trustee Napkin Finance Has The Answer For You

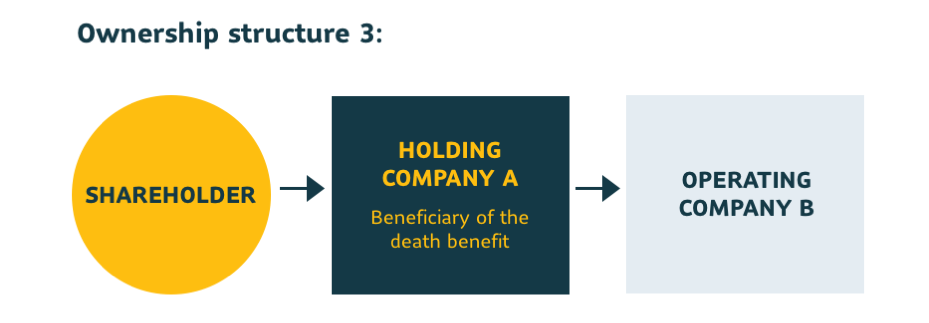

Sun Life Advisor Site Corporate Ownership Of A Life Insurance Policy

Annuitant What It Is And How It S Different From The Annuity Owner